Support Télécom Saint-Etienne’s development by donating the balance of your taxe d’apprentissage.

Why collect the balance of the taxe d’apprentissage?

More than ever, Télécom Saint-Etienne is a beneficiary of this contribution and needs your support.

In the same way, your company can continue to count on the school to support its innovations and train its future employees.

The digital sector needs the skills of our school: engineers specializing in digital technologies (photonics, electronics, networks-telecom, digital imaging, IT), executives in digital mediation and design, developers…

How to pay your taxe d'apprentissage to Télécom Saint-Etienne?

Once you have obtained your access code, access the Soltéa allocation platform to allocate your balance to Télécom Saint-Etienne – UAI code 0422026Z.

Please note that in the “Follow-up of allocation requests” column, please tick the box indicating that you agree to Télécom Saint-Etienne seeing your allocation, so that we can monitor your payment.

Notify us of the amount allocated by emailing ta@telecom-st-etienne.fr.

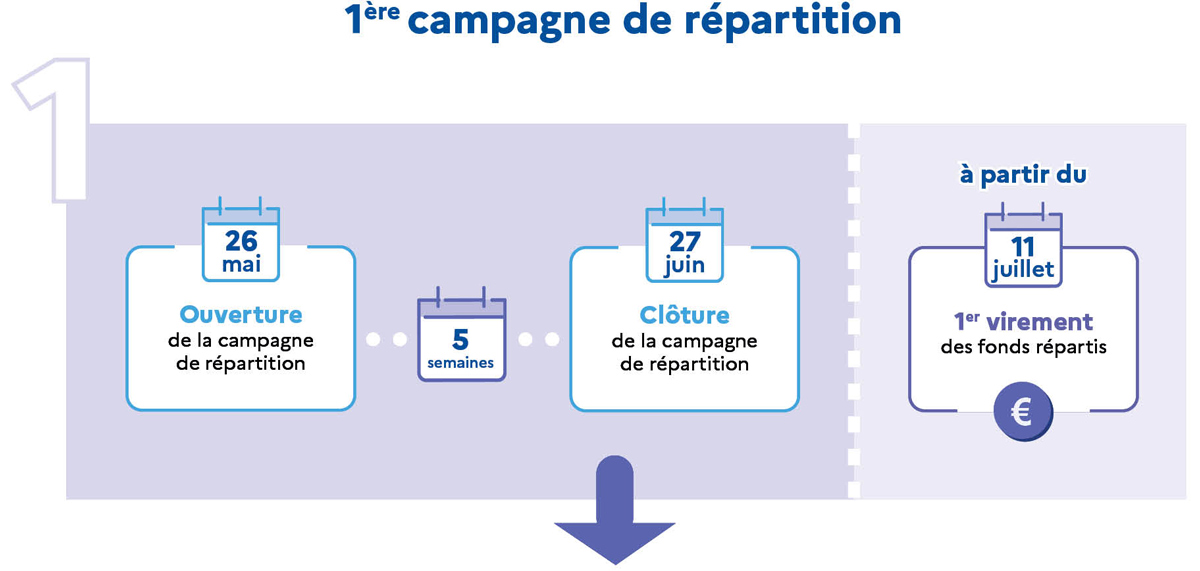

- Opening of the platform: From May 19, 2025 for establishments to check or complete their information and from May 26, 2025 for employers.

- 1st allocation period: May 26 to June 27, 2025

- 1st transfer of funds distributed to establishments by employers: from July 11, 2025

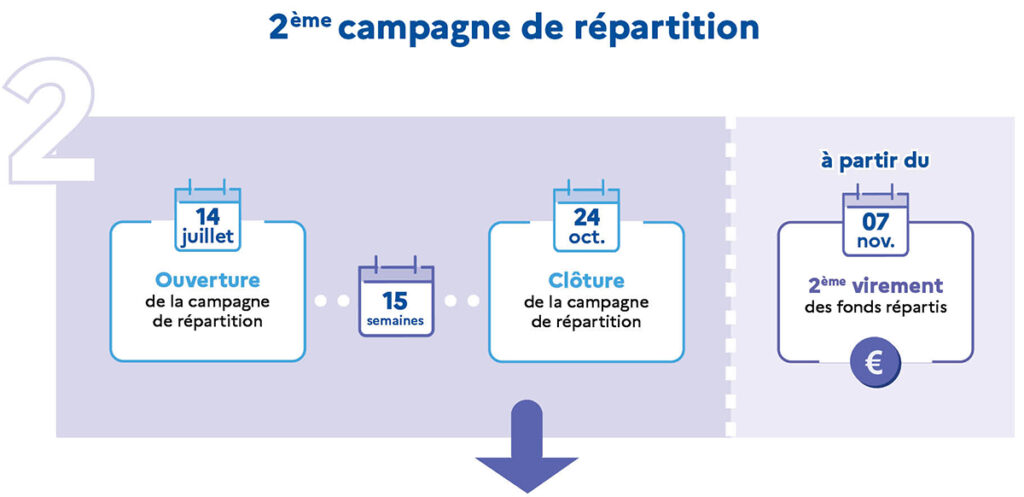

- 2nd allocation period: July 14 to October 24, 2025

- 2nd transfer of funds distributed to establishments by employers: from November 7, 2025

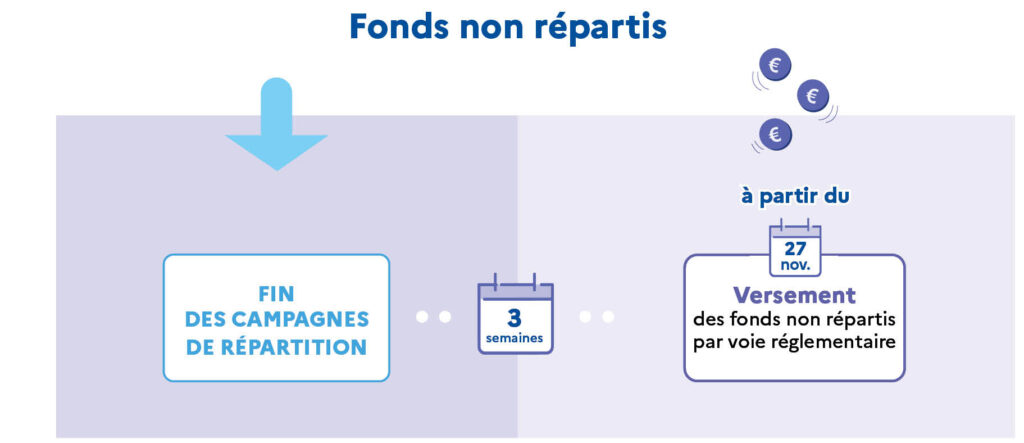

- Payment of undistributed funds by regulation as of November 27, 2025

Estimate your apprenticeship tax balance 2025

Your company’s total payroll in 2024, in €.

Enter a value to estimate your apprenticeship tax balance

Calculation: 2024 gross payroll multiplied by 0.09%.

By choosing to donate your Taxe d'Apprentissage to Télécom Saint-Etienne, you :

Become a privileged partner

of a school resolutely oriented towards the business world (internships, work-study programs, projects, conferences, forums, continuing education, research and corporate events every month), and gain visibility among students.

Take part in the 2024 projects for the school and its students:

- Continued renovation of student engineering courses, with the introduction of a third-year “Cybersecurity” apprenticeship.

- Creation of a capture/data platform

- Creation of a scheme for students to be supported by companies, particularly local VSEs/SMEs.

- Intensifying international mobility for our students

Take advantage of the

partner rate to take part in our events or contract an engineering project with our students and lecturers.

Support the development of an innovation-oriented school in tune with business expectations.

Contribute to the skills development of your future employees by promoting quality teaching.

Need to take some information with you?

Discover Télécom Saint-Etienne’s 2025 apprenticeship tax brochure.

6 training courses are eligible

- Telecom engineer Saint-Etienne

- Ingénieur Télécom Saint-Etienne – Computer Science and Electronics specialization (Computer Science and Electronics for Data Engineering)

- Ingénieur Télécom Saint-Etienne – Specialization in Photonics and Industrial Computing (Image and Photonics, for Smart-Industry)

- DU – Cycle Initial En Technologies de l’information de Saint-Etienne (Citise integrated preparatory class)

- Bachelor Global Communication & Digital Design

- Master Information-Communication Communication Design – Innovation & Digital Mediation course

3 reasons to support us

Gain visibility

to our students for your internship, project, work-study and job offers

Take part in our events

companies and meet our students throughout the year

Benefit from our support

for your research, development and innovation activities